Germany’s financial supervisor BaFin has published its 2026 risk assessment. For banks and loan servicers, three areas demand particular attention: rising default risks in corporate lending, persistent stress in commercial real estate, and growing liquidity challenges at property funds. The regulator announces intensified supervisory measures.

Corporate Loans: NPL Ratios Above EU Average

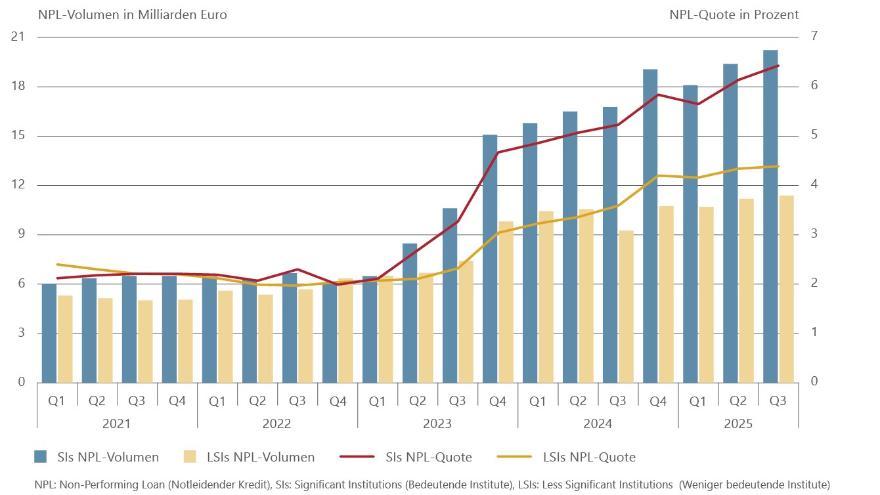

BaFin continues to monitor elevated credit risks in corporate lending. NPL ratios for significant German institutions in corporate business recently exceeded the Single Supervisory Mechanism (SSM) average, while coverage ratios remained below average. The authority warns that earnings could be burdened by rising provisioning needs.

The trend of increasing loan loss provisions continued in 2025, albeit at a slower pace. German banks have tightened lending standards and implemented higher risk premiums for certain loan requests.

Commercial Real Estate: Mixed Picture with Risk Potential

While the residential property market has largely normalized, commercial real estate continues to pose significant risks for banks. CRE loans accounted for approximately nine percent of German banks’ aggregate balance sheet in Q3 2025. BaFin emphasizes that individual institutions could be severely affected by larger loan defaults.

Banks specializing in CRE and project development financing face elevated risk. Transaction volumes and new lending have remained at low levels for years. Since the market correction in mid-2022, several project developers have filed for insolvency.

Property Funds Under Pressure

The German property fund market comprises 1,117 funds with total assets of EUR 323.6 billion. Since August 2023, open-ended retail property funds have experienced continuous net outflows totaling approximately EUR 13 billion. In January 2026, a smaller fund was forced to suspend redemptions.

Two institutional property funds also suspended redemptions in 2025. Affected investors included banks, insurance companies, and pension funds – a reminder of the interconnectedness of the financial system.

Foreclosures Continue to Rise

Parallel to these developments, German foreclosures increased by 4.7% to 14,082 properties with a total appraised value of EUR 4.76 billion in 2025. Seventy percent involved residential properties. The expiration of ten-year fixed-rate periods from the low-interest era could drive further increases in coming years.

Supervisory Measures for 2026

BaFin announces intensified cross-sectional analyses for 2026 to identify risks such as concentrations or defaults in CRE lending at an early stage. The regulator will assess whether banks are valuing their CRE portfolios appropriately and regularly. Special audits will be conducted at banks with elevated risk profiles.

Further reading: For a comprehensive overview of the German NPL market, see the BKS Annual Publication. Join industry experts at the BKS Management Day on March 10, 2026 to discuss current developments.